Lately the news has been awash with debates about Stock Buybacks/Repurchases. As the, all too real, fight between Capitalism and Socialism (a topic that will be covered in-depth throughout future blog posts) commences. Stock Buybacks have found themselves in the cross hairs as something that symbolizes everything EVIL about Capitalism (How often does a chance to use “Showcard Gothic” font come up?).

First, let’s discuss what Stock Buybacks are. In simple terms, stock buybacks are when a company repurchases shares of stock that have already been released to the public. These shares are repurchased by the company at market value per share.

If a company raises money (equity) in order to fund growth by selling their stock, why would a company ever want to repurchase their own stock back?

There are a few reasons a company may want to repurchase their stock. Undervaluation of their stock, re-balancing ownership ratios, and the effect on key metrics such as Earnings per Share are a few.

Huh?

Ok, so if a company is projected to have $10M in Earnings (Net Income/Profit) and has 2 million shares out in the public, they are projected to have EPS (Earnings per Share) of $5 ($10,000,000 in earnings/2 million shares=$5 EPS).

But, ummm…why is EPS important? Well, EPS is one of many financial indicators to tell you if a company is a good investment. This, obviously tells you how good the earnings (Net Income/Profit) are per outstanding shares trading in the market.

When you own a share of stock, you own a piece of that business. If the business decided to pay out all the profits it made to the stockholders, then EPS would basically tell you how much money you are getting for every share you own. This is why EPS is important.

Of course, the world does not work that way. A business needs to grow and adapt with the times, so they typically reinvest profits to keep growing the business in the hopes that future EPS are even higher. EPS then becomes a representation of the potential money you could be making as a stockholder if they did pay out their profits. Another time we will discuss Dividends which are when a company does in fact pay some of those profits out to shareholders, but not today.

Take a breather, we’re almost to the fun part.

Investors want to invest in businesses that are growing and profitable. A positive EPS represents a business that accomplishes both of these things and indicates how much value the investor is getting.

So…back to our example. Our business has projected earnings of $10M and has 2M outstanding shares of stock, but then decides to buyback/repurchase 1M shares of stock. Their EPS just went from $5 (10M/2M=5) to $10 (10M/1M=10)!

Why the outrage over Stock Buybacks? Well, this is where economics, business, and politics have a messy little menage-a-trois. The main argument against stock buybacks are the assumption that every dollar of the business not paid out to shareholders via dividends, should be re-invested into the assets of the business, the employees working there, or R&D to help develop new streams of revenue. When put like that, I have no problem with these ideas. However, there is so much nuance to this discussion that blanket generalizations calling for government regulation, in my opinion, are dangerous.

One article in The Atlantic (Article here) argues that if companies were to forego stock buybacks and reinvest every dollar of net income back into wages, “Lowe’s, CVS, and Home Depot could have provided each of their workers a raise of $18,000 a year, the report found. Starbucks could have given each of its employees $7,000 a year, and McDonald’s could have given $4,000 to each of its nearly 2 million employees.” However, lets unpack that sentiment for a moment. What real benefit is it to the company to do that? If every employee at McDonalds gets a $4,000 raise does that mean the number of times they forget my bar-b-que sauce will dramatically decrease? Will Starbucks workers stop misspelling my name on my triple venti half-sweet non-fat caramel macchiato? No, they fucking won’t. The market sets value on things for a reason! It would be nice for a business to choose to have a more social impact, but how much government intervention should we be ok with? Should businesses not have to care about profits? One major reason this thinking is scarily flawed is that anomalies occur. What happens if I have record profits one year, but next year the economy tanks? If I pay out dividends, that money is gone, but it is a one-time hit to my equity. If I give everyone at my McDonalds a $4,000 raise, that is a reoccurring profit hit every year, and it compounds with annual raises, bonuses, etc. If my profits tank the next 2 years and I have to reduce staff in order to stay profitable, I may now need to reduce my staff by 6 people to adapt to the decline in profits, as opposed to 1 person had I not given everyone “non-value added” raises. That means more jobs will be lost (I made a spreadsheet to prove this theory out: McDonalds Example). However, if I had repurchased shares of stock, and the next year we need to raise capital to fund investments because profits are down, I can re-release those repurchased shares to the public again, granted at a lower stock price, but it’s the safest action of the three in this scenario.

<All information for the McDonalds PDF was real financial information taken from here: (McDonalds Financials).>

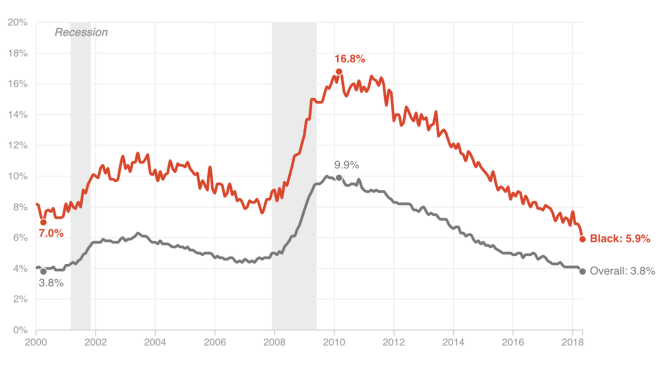

An article in the NY Times, boldly stated that companies should not be beholden to maximizing shareholder value, stating “The stranglehold of this doctrine of “shareholder-value maximization” over corporate decision making has been a leading cause of inequitable incomes, unstable employment, and sagging productivity (NY Times).” Unstable employment and sagging productivity? Really??? We are more productive now than we have EVER been and employment rates are at levels not seen since war time years when we had half the country working towards war efforts.

(Sorry, the best chart I found was comparing Black unemployment to all Unemployment)

All-time high productivity starting to peak and reach it’s limits, but revenue keeps climbing…which means extra capital to spend elsewhere

I will not argue that wages are not moving the way they typically do when employment is low and productivity is high, but I don’t think that stock repurchases are the boogie man causing this. However, shareholders bear a lot of risk investing in companies, and like it or not should have value returned to them for taking on that risk. Remember when we talked about how owning a share is basically owning a piece of the business? Imagine you are a small business owner and you have a restaurant with 15 employees. Your employees are all paid as well as every other restaurant for a 500-mile radius (so, at market value), if not a little higher and you have all new equipment (assets) that won’t need to be replaced for some time. If you have record profits one year should you have to buy equipment that you may not currently need or give it back to the employees although they are already at maximum capacity with their job duties and cannot be any more productive? As the business owner (you are basically a shareholder with 100% of the shares), you have risked everything to get this business running. Emptied your savings, sleepless nights, learned the hard way what to do and not do as you got things running, you have risked it all and now someone is saying you don’t deserve a piece of the success for all of that risk. Obviously, this is an extreme example, but shareholders of a business are putting in their hard earned money to fund a business. They are taking a major bet, when they could just put it in a savings account, that it will turn out to do well and return some value to them. You could argue it’s not like they are actually doing anything, but buying some stock, they aren’t having sleepless nights like in the small business example. However, in a way that could be argued as even riskier. They are betting on management they have never met to make decisions they have zero say in with money they are banking on to “maybe” return value one day. If that isn’t risky then I am not sure what is. It’s literally a bet, albeit it an educated one assuming you put some thought into why you want to invest in that business. If I go to the casino and place a wager on a football game, I am placing a lot of money on a group of guys to go out there and play well and I have zero control over success or failure. I get paid a lot of money back to me if I win, because I am taking on so much risk. I could invest in treasury bonds that have little to no risk, but very small returns over a long period of time, but the risk I am willing to take on should be matched by the returns I get back if successful. Additionally, shareholders use the returns to keep investing, “Capital flowing to…shareholders does not go down the economic drain: Shareholders use much of the cash, we know, to invest in smaller public and private firms, supporting innovation and job growth throughout the economy (Harvard Business Review).”

In a Seeking Alpha article, the author argued “For one, buybacks are a sign of short-termism among executives, the argument goes, boosting shareholder value without boosting the underlying value, profitability, or ingenuity of a given firm. Companies do not get better because of buybacks; it is just that shareholders get richer (Seeking Alpha).” I will discuss my major issues with short-termism another day, but again I would argue that free markets should regulate themselves when it comes to buybacks. Executives are paid a lot of money for a reason. If they are using money that truly should be going towards investment in employees, assets, or R&D on share repurchases instead, these businesses will fail at some point. That is the business cycle. Snakes shed their old skin to allow for growth and remove parasites that are attached. Free markets are the same. Businesses fail and businesses succeed and if they are not adapting they will die and a new, more intelligently run business, will spring up in its place. For this reason, I would argue stock buybacks are not replacing necessary investments because businesses would die if they were literally taking all of the dollars meant for reinvestment and only repurchasing shares.

These are the main reasons that stock buybacks being singled out are a little crazy to me. I did not even mention that R&D spending has gone up year over year or that maybe companies left after the Great Recession were the leanest and most efficient, already weeding out those that poorly allocated capital. However, this is coming up before the midterms and it is an easy target because a lot of people aren’t well versed in business finance or critical thought for that matter. Additionally, you can then exacerbate the problem, by attaching it to Trump’s tax cuts and the fact that trickle-down economics never really works. The problem is, this isn’t about one or the other. Many companies are like Alaska Airlines, who used a lot of their tax savings to buy shares back (repurchasing 185K shares for $12M (Here) and also give out a $1,000 bonus to 23,000 employees ($23M in expense) on top of $118M in incentive bonuses (Here). Apple is spending $100B in Stock buybacks. When have you ever not seen Apple on the lists of best companies to work for (Apple one of only 3 companies rated ‘best places to work’ for 10 years) or someone say I wish Apple spent more on R&D because they just aren’t innovative? Yea, me either. However, the more nuanced spending stories don’t generate flashy headlines or political opposition. I could be wrong, and if you have counter opinions, let’s talk about it, but stock buybacks seem to be the new Frankenstein (pronounced Fronck-En-Steen) and in today’s overly outraged society politicians are all too eager to hand out the pitchforks and torches while journalists point to his house.